Life insurance provides financial protection in the form of a lump sum payment when the policyholder dies in return for a monthly premium.

A joint life insurance policy is perfect for parents as it protects 2 people.

Joint life insurance is a great way to provide financial protection for your loved one, or to ensure the continuance of your business should one partner pass away.

If you are considering life insurance, speak to Life Compare today and our team of experts wil help you find the policy best for you.

Get a low cost life insurance quote today!

Table of content

What is joint life insurance

Joint life insurance covers the lives of two or more individuals on the same policy. It generally offers protection to spouses or civil partners or to business partners.

With most joint life insurance policies, the surviving spouse or civil partner, or business partner receives the death benefit or lump sum.

Joint life insurance for spouses or civil partners

If you and your spouse or civil partner wish to provide financial protection for the other should one of you die, then you can purchase joint life insurance.

Joint life insurance can be term life insurance, which pays a benefit if either you or your partner die during the term of the policy, or whole of life insurance which will pay out whenever you die.

With joint life insurance, both partners are covered for the same cover amount and, if you choose term life insurance, for the same term.

With joint life insurance, there is a single death benefit. This means that the policy pays out once on either the first or second death. Life cover will cease following the death of one spouse or partner.

Joint financial protection

Joint term life insurance and joint whole of life insurance are two types of financial protection that can cover two lives in one policy.

It is also possible to purchase mortgage protection and specified illness cover as joint policies that cover two policyholders.

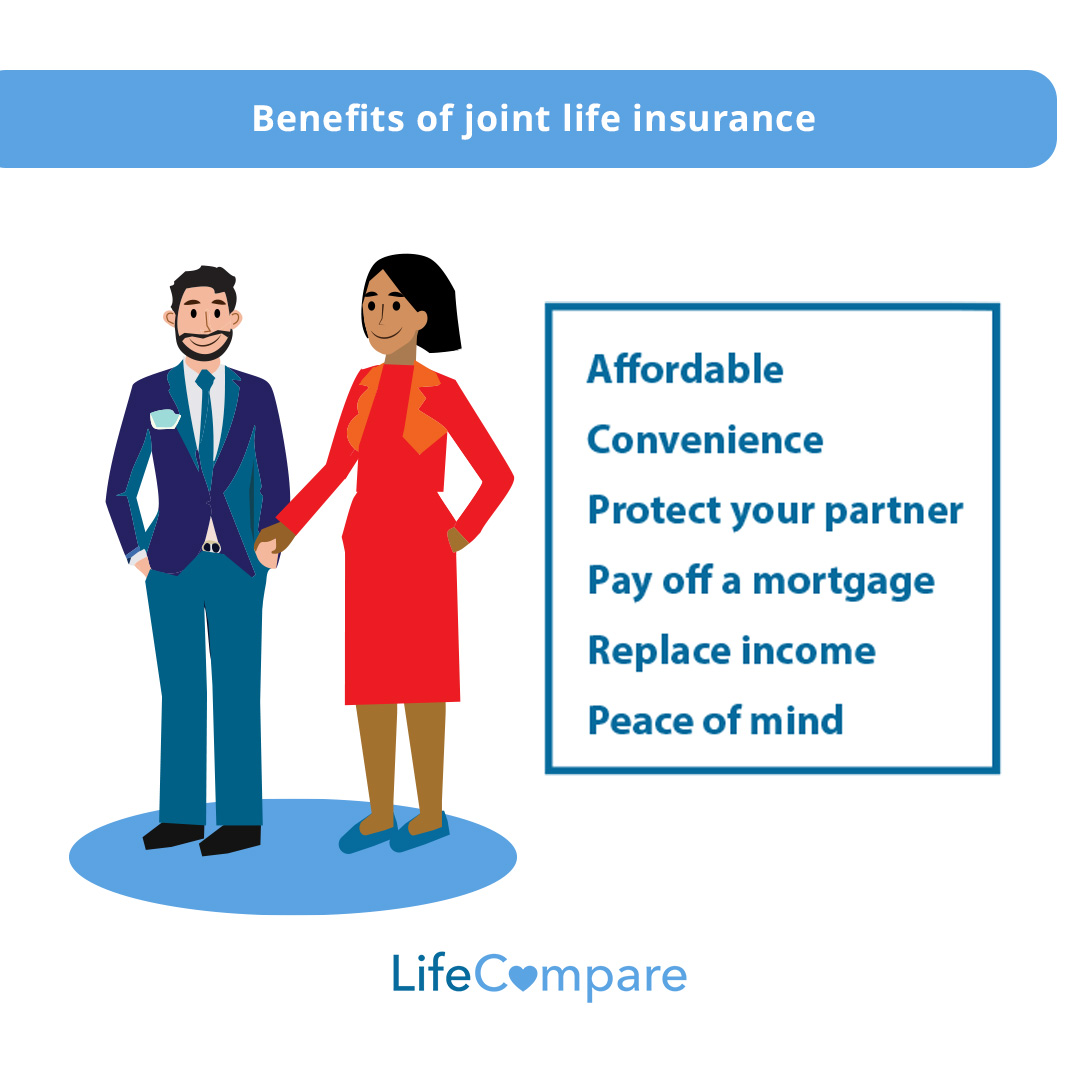

Benefits of joint life insurance

The advantages of joint life insurance include:

Joint life insurance to pay inheritance tax

A joint life second death, or second to die life insurance policy pays on the death of the second policyholder only, or after both policyholders have died.

Generally, on the death of a spouse or civil partner, the estate passes from one spouse to another without any inheritance tax liability.

However, on the death of the second spouse or civil partner, the beneficiaries of the inheritance may be liable for inheritance tax, depending on the value of the assets that they inherit.

Joint Section 72 insurance

Section 72 is a whole of life insurance policy, meaning that it will pay out whenever you die. This type of life insurance is set up in a tax efficient way, to provide for inheritance tax liabilities of those who benefit from your estate.

A joint life Section 72 insurance policy can be used in estate planning to provide cover for this inheritance tax liability.

Here the death benefit provided by the insurance policy is paid to the children or beneficiaries of the estate to cover the inheritance tax.

Business joint life insurance

Business partners can take out a type of joint life insurance that ensures the continuation of the business should one of them die.

Sometimes called partnership insurance, this type of life insurance can provide cover for the lives of two or more business partners and reduce the legal and financial risk to your business.

Put simply, when one business partner dies their share of the business becomes part of their estate.

Partnership insurance

With joint life insurance, or partnership insurance, the remaining partner can use the death benefit or lump sum provided by the policy to buy out the deceased partner’s share of the business from their next of kin or the beneficiaries of their estate.

This will also mean that the surviving partner(s) will maintain full control of the business and the business will continue to operate.

Who provides joint life insurance?

All of the main life insurers provide joint life insurance:

Section 72 life insurance is provided by:

Partnership insurance is provided by:

Life Choice Assets

Contact us today

Joint life insurance provides invaluable protection but can be a complex insurance product and it is best to get advice before purchasing to ensure that you choose the correct cover for your needs.

Whether you are considering joint life insurance for personal or business reasons, discuss your options with our insurance advisors at Compare Insurance. Our qualified advisors can discuss your circumstances and insurance needs with you and find you affordable cover that suits your circumstances.