Life insurance offers you and your family protection by paying a tax-free lump sum when you die.

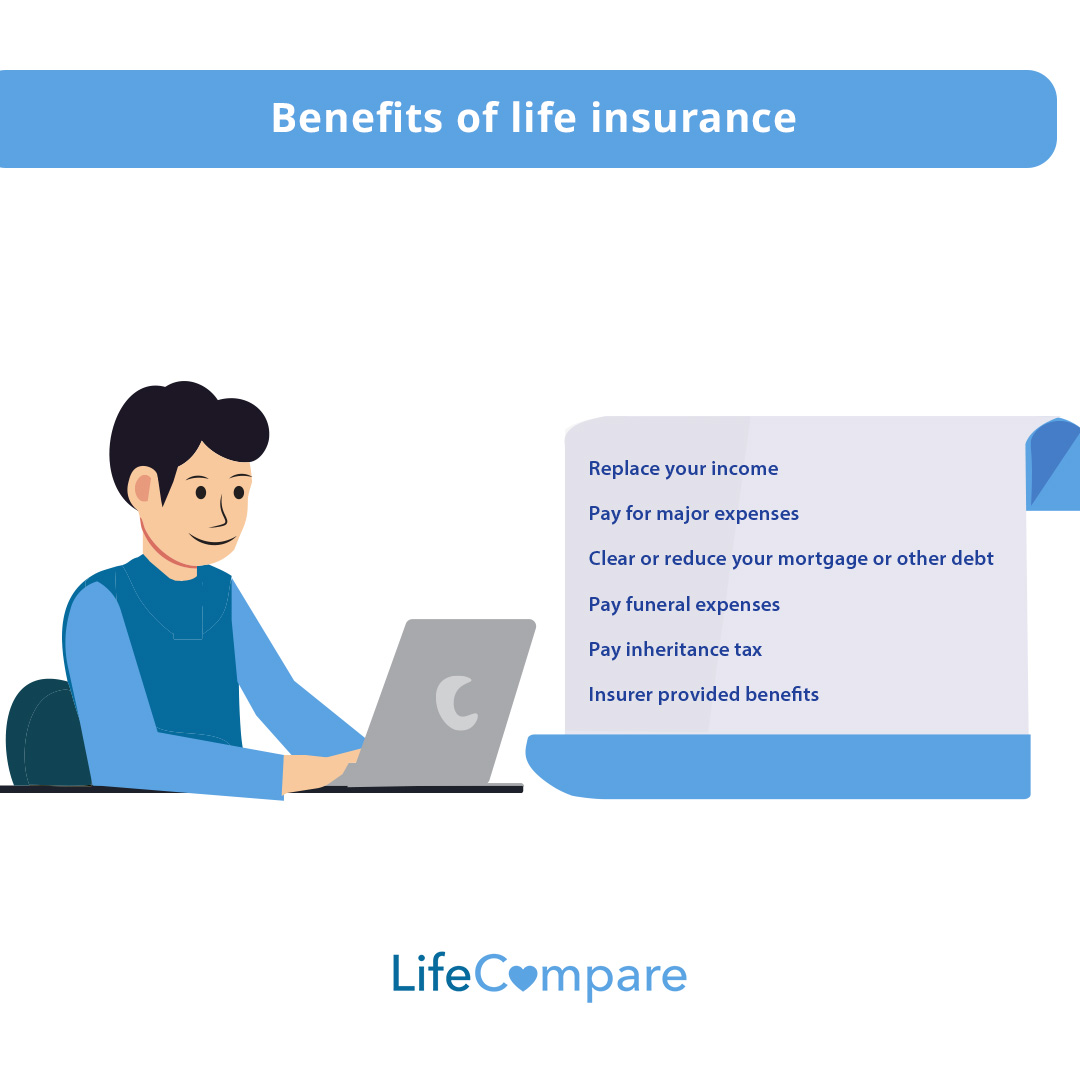

Apart from the freedom from worry of knowing that your loved ones will be secure should you die unexpectedly, there are financial benefits of life insurance:

Replace your income

If your family relies on your salary, life insurance will replace your income to offer them financial security.

If you are a stay-at-home parent, life insurance will offer some financial support for expenses such as childcare, housekeeping, and transport which you provide.

Pay for major expenses

The cash lump sum provided by life insurance can help your family to meet the costs of major expenses which might be more difficult to provide for should you die.

Depending on the ages of your family, this may mean childcare, education, retirement for your spouse, or care for a dependent relative.

Clear or reduce your mortgage or other debt

Depending on your stage of life or financial situation, you may leave significant amounts of debt behind if you die.

The lump sum provided by life insurance will help your family to clear a mortgage or any outstanding debts, especially if they face a drop in income following your death.

Pay funeral expenses

Those you leave behind may face immediate expenses when you die such as your funeral.

Funerals can cost thousands of euros, so protect your loved ones from these bills with life insurance.

Pay inheritance tax

Inheritance tax for anyone other than your spouse can add up and a life insurance lump sum can be used to pay inheritance tax.

There is a specific form of life insurance, Section 72 life insurance that can be set up specifically to cover inheritance tax.

Insurer provided benefits

Life insurers offer benefits to their customers other than the life insurance itself.

Most life insurers offer medical advice in the form of nurse or GP advice lines, counselling or mental health support, and medical second opinion services.

Contact us today

Life insurance offers many benefits in terms of peace of mind, as well as financial benefits if you should die during the term.

If you wish to protect your family in the event of your dying earlier than expected so that they are not left financially vulnerable, the tax-free lump sum provided by life insurance is invaluable.

However, life insurance is complex and there are many options.

Talk to us today or fill out our online assessment and our insurance advisers can find you the best cover for your circumstances and budget.