Life insurance is an important consideration for anyone who wants to ensure that their loved ones are financially protected in the event of their death.

Life insurance can be used to cover funeral costs, outstanding debts, or living expenses for the beneficiary.

This can help ease the financial burden on loved ones left behind, allowing them to grieve without having to worry about finances. Additionally, many policies also offer additional benefits such as critical illness cover or income protection insurance, which can provide further financial support.

Choosing the right life insurance cover can be difficult and there’s a lot to consider when choosing the right life insurance partner to suit you and your needs. Before making a decision you will need to consider your specific needs and budget.

In Ireland, there are a variety of life insurance cover options available, from term life insurance to whole life insurance.

Before comparing costs and providers, it’s essential you know exactly what life policy applies to you and your specific needs.

Table of content

Dual Life or Single life insurance?

Single life insurance, also known as personal life insurance, provides coverage for one person and pays out a death benefit to the designated beneficiary upon the policyholder’s death.

This type of policy is best for individuals who are single, divorced or have children from different marriages. It is also a good option for people who want to ensure that their children or other beneficiaries receive a specific amount of money after they pass away.

Joint life insurance provides coverage for two people, typically a married couple. The death benefit is paid out upon the death of the first policyholder, and the policy is typically less expensive than two separate single-life policies. This type of policy is ideal for married couples who want to ensure that the surviving spouse is financially protected in the event of the other spouse’s death

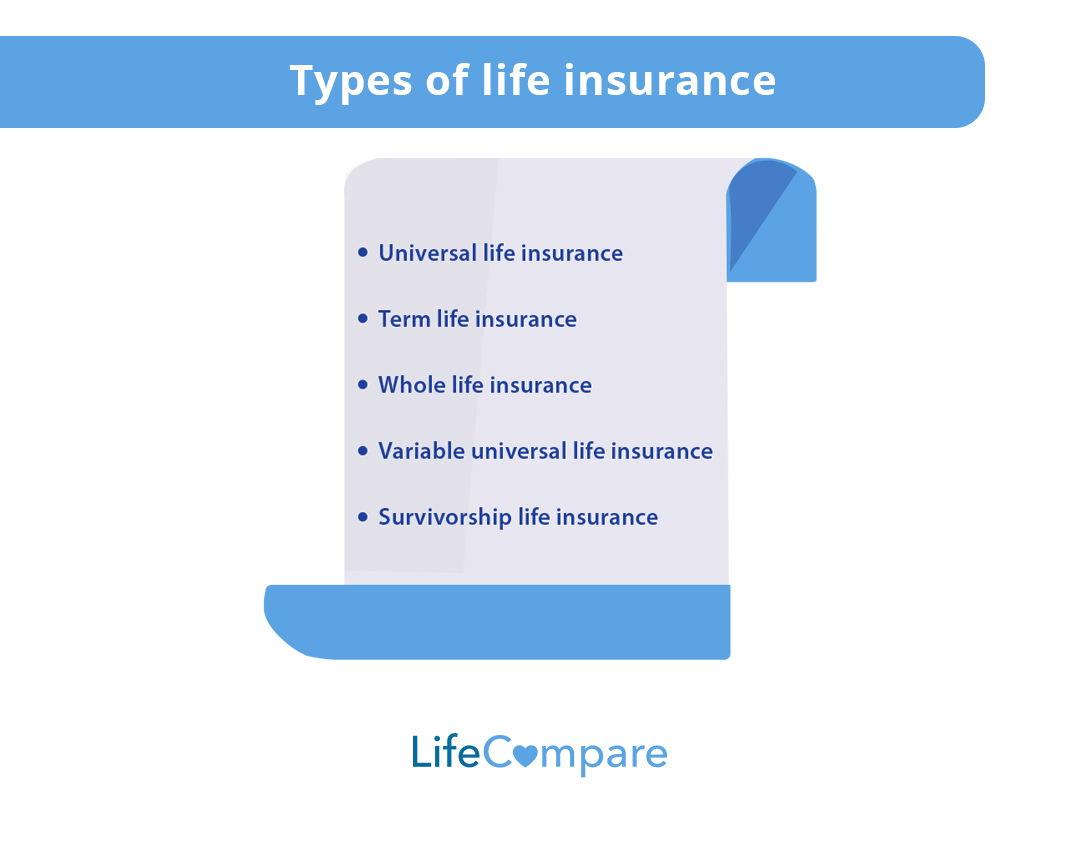

Types of life insurance available

Life insurance is an important aspect of financial planning, as it provides financial protection for you and your loved ones in the event of your premature death. In Ireland, there are various types of life insurance available, each with its own unique features and benefits:

Single cover

Single-cover insurance is a policy that provides coverage for one individual. Single-cover insurance can be either term life insurance or whole life insurance, depending on the policyholder’s needs and budget.

Joint cover

Joint cover insurance is a policy that provides coverage for two individuals, typically a married couple or partners. This type of policy is often taken out by couples who want to ensure that both partners are covered in the event of a premature death.

Dual cover

Dual cover life insurance is a type of life insurance policy that provides coverage for both an individual and their partner. This type of policy is typically taken out by couples who want to ensure that both partners are covered in the event of a premature death, but also want the flexibility of having separate coverage.

Dual cover life insurance is essentially two single life insurance policies, one for each partner, bundled together under the same contract. Each partner will have their own policy, with their own coverage amount, premium, and beneficiaries. This allows for flexibility, for example, if one partner wants to have a higher coverage amount than the other, or if one partner has health issues that would make it difficult to get coverage under a single policy.

Like single-cover insurance, dual-cover life insurance can be either term life insurance or whole life insurance, depending on the policyholder’s needs and budget.

Term cover

Term life insurance is a type of policy that provides coverage for a specific period of time, typically between 10 and 30 years. The policyholder pays a premium during the term of the policy, and if the policyholder dies within the term, their beneficiaries receive a death benefit.

Term cover life insurance policies are often more affordable than whole life insurance policies, and the premium payments are generally fixed for the duration of the term. This makes it a popular option for individuals who want to ensure that their loved ones are financially protected in the event of their death, but do not qualify for premium payments.

Whole life cover

Whole life insurance is a type of policy that provides coverage for the entire lifetime of the policyholder. The policyholder pays a premium for their entire life, and if the policyholder dies, their beneficiaries receive a death benefit.

Over 50’s cover

Over-50s insurance is a type of policy that is specifically designed for individuals over the age of 50. These policies typically have lower premiums and do not require a medical examination, making them a good option for older individuals who may have health concerns.

Our Process

We make the life insurance process as simple and streamlined as possible, and that’s one of the reasons we’re maintain a 5★ rating from our customers!

Assessment

The first step is to take a few moments and fill out our interactive life insurance assessment form.

Review

Your assessment is sent directly to a life insurance expert. They will review your data, get your quotes and schedule a call with you to discuss your options.

Quotes

Your life insurance advisor will talk you through the pros and cons of each policy. Once you have decided which policy you would, your advisor will submit your application on your behalf.

Who offers life insurance in Ireland.

Life insurance providers in Ireland include:

Learn more about life insurance in Ireland

Deciding which type of life insurance suits you and your needs is the first step to taking out the right policy.

By comparing different life insurance policies, you can make an informed decision about which policy is right for you and ensure that you have the right level of protection in place to provide for loved ones.

It’s important to note that the specifics of each type of policy may vary depending on the insurance company offering the policy.

It’s always recommendable to consult with a financial advisor or insurance professional to determine the right type of life insurance policy for your individual needs and circumstances. Use our life insurance calculator to get the best value for you and your loved ones.