One of the major questions we ask ourselves when weighing up different life insurance policies is the length of time we want our coverage to run for.

If you are in a position where you want to safeguard your life insurance policy for the duration of your life, you will likely be looking into permanent life insurance policies.

A permanent life insurance policy never expires, covering the entirety of your life as opposed to a specified period of time covered in a term policy.

One type of permanent life insurance available in Ireland is universal life insurance, which may be best suited to your needs depending on your financial situation.

Oftentimes, universal life insurance is thought to be overly complex and subject to many variables, but its components can be quite easily understood.

Table of Content

What is Universal Life Insurance?

Universal life (UL) insurance is a type of permanent life insurance policy that holds a cash value and can offer policyholders flexibility on their premium payments.

Let’s break that down – holding a cash value means that certain universal life insurance policies allow you to benefit from them while you are still living.

You may choose to withdraw funds early from your policy, meaning its net cash value, i.e., its worth at the time of your death, will be proportionately reduced.

Flexible premiums mean UL insurance policyholders can choose how much they want to pay for their premium each year, provided they meet an agreed upon, minimum amount.

Types of Universal Life Insurance Policies

Within the umbrella of universal life insurance, there are three policy types:

Guaranteed Universal Life Insurance (GUL)

With a GUL policy, your premium payments and death benefits are fixed. The cash value, as a result, is reduced and it tends to be the least expensive form of universal life insurance.

Variable Universal Life Insurance (VUL)

With a VUL policy, your life insurance fund is tied to subaccounts that usually contain stocks and bonds. This means the policy is subject to change – a VUL policy may require good management so as to maximise its investment gains and minimise losses.

Indexed Universal Life Insurance (IUL)

IUL policies are similar to VUL policies – the only difference is that an indexed universal life insurance policy is tied to a stock market index. The value of your IUL policy will fluctuate according to the rises and falls in the index.

Who is Best Suited to a Universal Life Insurance Policy?

Those looking at universal life policies are usually financially secure and looking at preserving the financial safety of their beneficiaries in the long-term.

If you are an older individual looking to build a fund in a short space of time, or a younger client with family and mortgage expenses to contend with, you may look toward a term policy that better suits your situation.

However, if you have the means and you want to protect yourself and your family’s financial future, a UL policy is worth considering.

If you are less interested in the cash value element of a UL policy, and primarily concerned with covering the entirety of your life, a general universal life policy may be best suited to you.

If you want to potentially maximise your investment, and prioritise cash value, a variable or indexed policy may be more your speed.

Who Offers Universal Life Insurance in Ireland?

There are several Irish insurance providers that offer universal life insurance policies, including:

If you are considering an alternative insurance provider, contact us directly at Life Compare to see whether we can facilitate you taking out a UL insurance policy.

Our Process

We make the life insurance process as simple and streamlined as possible, and that’s one of the reasons we’re maintain a 5★ rating from our customers!

Assessment

The first step is to take a few moments and fill out our interactive life insurance assessment form.

Review

Your assessment is sent directly to a life insurance expert. They will review your data, get your quotes and schedule a call with you to discuss your options.

Quotes

Your life insurance advisor will talk you through the pros and cons of each policy. Once you have decided which policy you would, your advisor will submit your application on your behalf.

Whole Life Insurance vs Universal Life Insurance

As has been discussed, UL insurance is a type of permanent insurance policy, but it is not the only one.

Whole life insurance is a long-term alternative that differs from UL insurance in several ways:

Other Types of Life Insurance

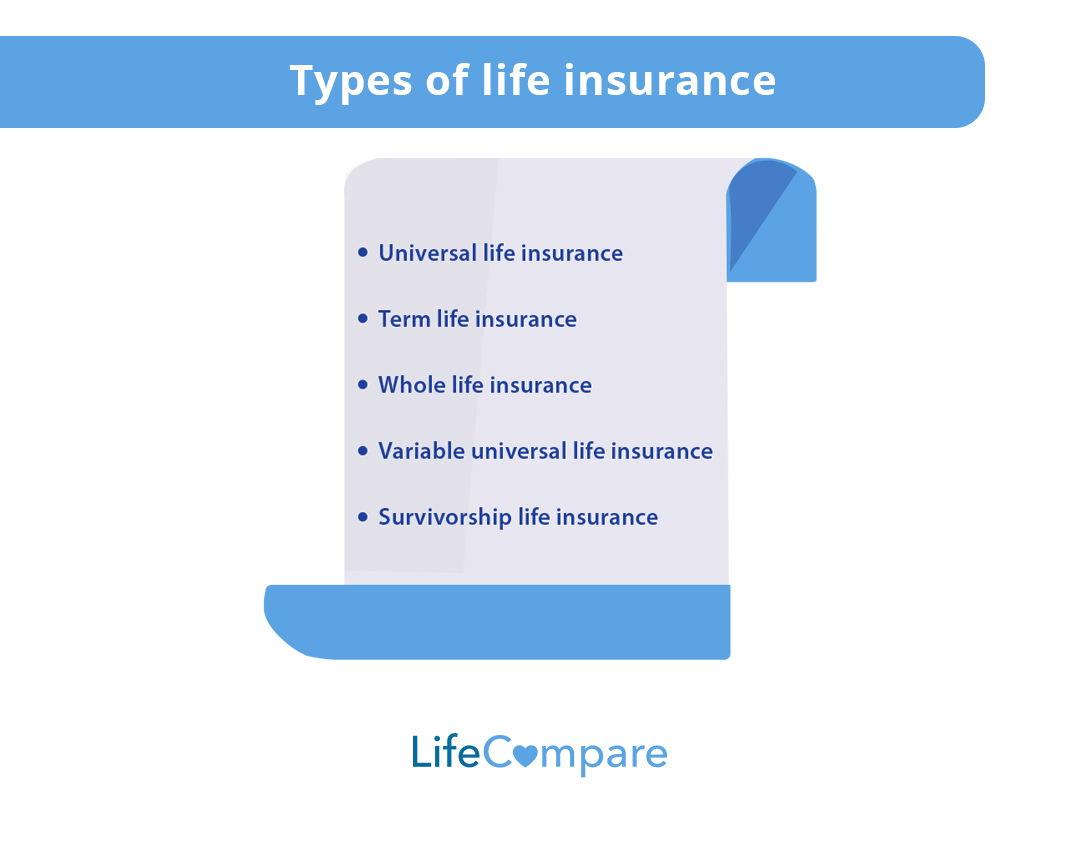

If universal life insurance does not feel like the right fit for your financial situation, you may want to learn more about the other types of life insurance.

Other types of life insurance include:

Single Cover Life Insurance

Single life insurance covers one person for a fixed term. If the policyholder dies during the term of the single cover policy, the insurance company will pay out death benefits.

Joint Cover Life Insurance

Joint life insurance is primarily aimed at couples, as it insures two people on one policy and only requires one, joint monthly premium.

Joint cover policies can provide payment in the event of the death of the first or last life involved. Joint cover life insurance is also referred to as dual cover life insurance.

Term Life Insurance

Where permanent life insurance covers policyholders for the entirety of their ordinary life, a term life insurance policy covers a specific period of time.

This period can be, for example, five, ten, twenty or thirty years. If the policyholder dies within this timeframe, the insurance provider will pay out death benefits.

Convertible Term Life Insurance

Convertible life insurance policies allow you to convert your term life insurance policy to a permanent life insurance policy without having to apply and qualify for an alternate form of insurance.

Depending on your agreement with your insurance provider, your convertible life insurance policy may allow you to swap to universal life insurance should you so wish.

Whole of Life Insurance

Whole of life insurance is a form of permanent life insurance that covers policyholders for the entirety of their lifetime.

It is a fixed and safe means of guaranteeing an inheritance for your loved ones.

Learn More About Universal Life Insurance Today

Take our online assessment to find out which type of insurance policy would best fit your financial situation.

Feel free to get in touch with our team at Life Compare today for more information on insurance policies and providers in Ireland.