Life can often be unpredictable. This is why it is always a good idea to have as much peace of mind and protection as you can.

Life insurance is a valuable way to give you and your loved ones financial reassurance should something unfortunate happen. Thankfully, there are a lot of measures you can take and options to choose from when it comes to life insurance.

At Life Compare, we offer all of our customers in Ireland various types of cover. This includes the likes of dual, whole, single and many more forms of life insurance.

If you are not sure what the best option for life cover is for you, then make sure you contact us. We will be able to answer your queries and help you in any way we can thanks to the experience of our team.

Another really effective way to ensure financial stability for your loved ones is through group cover life insurance.

Table of Content

What is group cover life insurance?

Group cover life insurance is something that an employer may offer the members of their staff. It’s something that an employer sets up on their own accord and applies to employees under contract with the organisation.

Also known as ‘death in service benefit’, group cover life insurance will apply whilst you are an employee of the company. It will only be paid out if you are an employee at the time of death.

This benefit is considered a type of term insurance. It is only valid for employees whilst under contract with an organisation.

As an employee, you cannot choose group cover life insurance as a form of life insurance. This is a form of financial benefit that can only be provided by an employer.

If you are an employer, then you might choose to provide group cover life insurance for your members of staff.

How does group cover work

Group cover can work in a number of different ways depending on the preferences and choices of the employer. They include the following:

Who sets up a life insurance group cover plan

An employer sets up a life insurance group cover plan. They will pay all premiums in regard to this life insurance.

They can choose between variables in regard to benefits, payment options and other factors.

Having group cover life insurance can be a significant benefit to employers. Some of the benefits employers may see from providing this life cover includes:

Our Process

We make the life insurance process as simple and streamlined as possible, and that’s one of the reasons we’re maintain a 5★ rating from our customers!

Assessment

The first step is to take a few moments and fill out our interactive life insurance assessment form.

Review

Your assessment is sent directly to a life insurance expert. They will review your data, get your quotes and schedule a call with you to discuss your options.

Quotes

Your life insurance advisor will talk you through the pros and cons of each policy. Once you have decided which policy you would, your advisor will submit your application on your behalf.

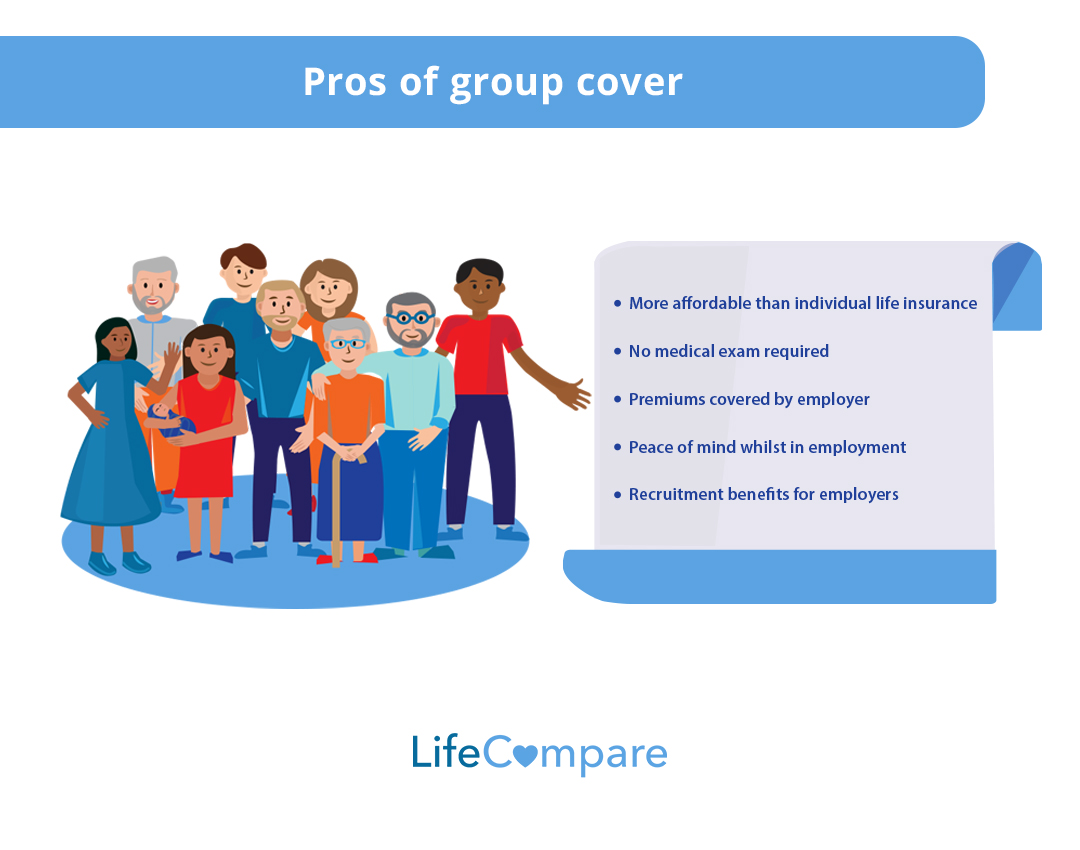

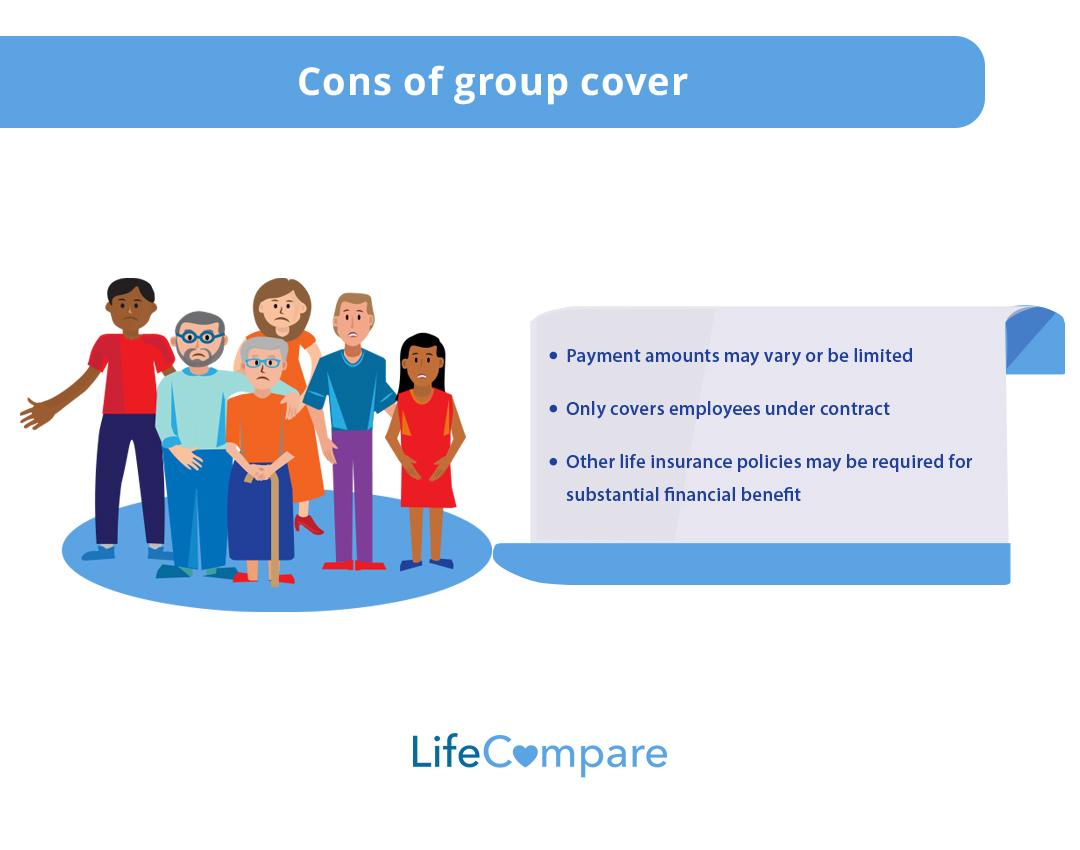

Pros and cons of group life cover insurance

Group life insurance has a lot of benefits for employers and employees alike. However, there are some other factors to consider in regard to group life cover.

Learn more about group cover life insurance today

If you have any queries regarding group cover life insurance, make sure you talk to a member of our team today.

We can offer you a free quote once you get in contact with Life Compare. This can give you much more clarity regarding any potential policy you have an interest in.

Life Compare constantly studies the market and aims to provide you the best insurance possible. So you can have peace of mind knowing you are getting the best deal.

Contact Life Compare today for all your group cover life insurance needs.