Life insurance in Ireland is cover for the unexpected and has many uses. It can pay your mortgage or provide for the family if you are not around. With a life insurance plan you can protect your business and cover investment or large bank loans.

Having life insurance is knowing that your finances are in order no matter what happens. The house is safe for the family. All school and college fees are covered, and the children are looked after until they become financially independent .

Nobody wants to think about not being around. The practical side is having the best life insurance cover to leave the family financially safe. The last thing they need is to suffer any more traumas.

In Ireland, life insurance policies come in many sizes but finding the right fit should not be difficult.

Table of content

What is life insurance?

Life insurance is a policy that pays out a lump sum on the holder’s death. A policy can be for a fixed term or specific purpose but offers financial protection to those left behind.

It may be an agreed tax free lump sum to cover a mortgage or a substantial bank loan. The policy can cover the holder for a fixed number of years, like the length of the loan agreement.

Parents take out life insurance to give their children financial security until they can stand on their own two feet.

Maybe your business needs cover for the skills you bring to the job. If you own and run the company, it could flounder without you being around to guide it. Investors may insist on you taking out life insurance.

What is essential is to have life insurance and to have the right policy for you.

You can get cover for your life only, single life, or one that includes your partner, dual life. If you are married or in a civil partnership, knowing your life insurance policy is always a benefit.

Single life v dual life insurance

Single life insurance v dual life insurance is a topic every couple faces when taking out life insurance cover. Knowing the difference between the two life insurance plans will help you make up your mind.

Single life insurance covers the name of the policyholder. If that person dies, the policy will pay out the agreed lump sum to the beneficiaries. The single life insurance is ideal for younger people taking out a business loan or their first mortgage.

Dual life insurance covers both names on the policy. When they die, the policy pays to their estate or clears outstanding debts. Married couples with children take out dual life cover so their children may benefit from their passing.

Single life or dual life insurance is one question to ask when you need life insurance.

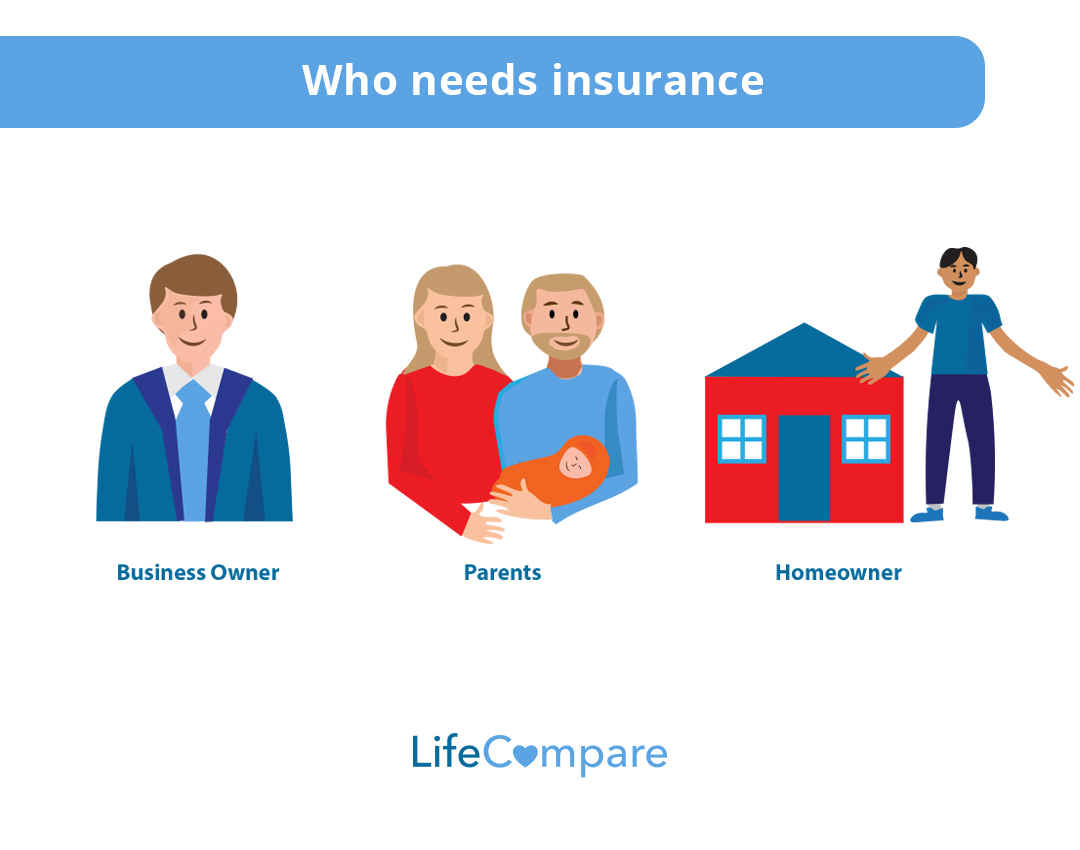

Who needs life insurance?

Everyone with financial responsibilities needs life insurance. If you die, those left behind will have to take on that responsibility. Nobody wants to think they won’t be around forever, but serious illness and accidental death is why you need life insurance.

Homeowners need life insurance to cover the mortgage owed on the property. The monthly payments will need covering, even if you die, so best to clear it when the unexpected happens.

Parents need life insurance to provide financial support for their children until they are independent. If you have a child with special needs, they will need care throughout their adult life.

Business owners will need life insurance to cover expansion loans and investments in the company. Your survival may be linked to that of the business, and life insurance offers the company that protection.

Knowing why you should have life insurance is an excellent way to make up your mind when looking at life insurance quotes.

Why should you have life insurance?

You should have life insurance to cover the needs of those left behind on your death. It is not a pleasant topic but one you must face at some stage in your life.

If you are young, free and single, the chances are life will change at some stage. Many people start a family, and you need to know that your family is covered by a life insurance lump sum in case of your death.

The same is true if you run a successful business and want to grow it. Investors and banks need to know their money is safe and want you to have life insurance.

Life insurance offers peace of mind

Life insurance offers peace of mind to those who have it. There are no more worries about paying the mortgage or leaving something for those left behind if you die.

Life is full of ‘what happens if’ questions. We worry about what happens if I die and the family is left alone. Life insurance products protect the family if they lose you to accidental death and helps them through the tough times.

Life insurance is good:

To cover debt

To cover debt such as a mortgage is a perfect use for life insurance. Most banks will insist you take out life insurance to cover the mortgage or a loan.

The life insurance policy usually is for the amount of the debt. The term of the policy is the same as the debt; if you die within that time, the life insurance pays the final amount due.

To protect against loss of income

To protect against loss of income is a popular use of life insurance for parents or guardians. The children will suffer if you are the primary earner for the family and die before they are financially independent.

Life insurance can provide a lump sum to cover childcare costs, school and college fees, medical expenses, and household bills.

The policy is usually taken out until the youngest reaches 25 and pays out if you die before that time.

To pay for funeral expenses

To pay for funeral expenses is another use of life insurance. A funeral can be expensive and is an extra cost for the family they will not want at the time.

You need not worry about burdening the family when you die with a simple funeral policy.

Life insurance for the Over 50s covers funeral expenses. It pays out a tax free lump sum to cover the funeral, and you will qualify without needing a medical.

Our Process

We make the life insurance process as simple and streamlined as possible, and that’s one of the reasons we’re maintain a 5★ rating from our customers!

Assessment

The first step is to take a few moments and fill out our interactive life insurance assessment form.

Review

Your assessment is sent directly to a life insurance expert. They will review your data, get your quotes and schedule a call with you to discuss your options.

Quotes

Your life insurance advisor will talk you through the pros and cons of each policy. Once you have decided which policy you would, your advisor will submit your application on your behalf.

What is the difference between life insurance and life assurance?

The difference between life insurance and life assurance is length of time they cover. Life insurance is for a fixed term, a set number of years. Life assurance, also known as whole of life insurance, covers you through all of your life.

Your life can throw up a serious illness at any stage and there are many types of life insurance to help deal with the consequences.

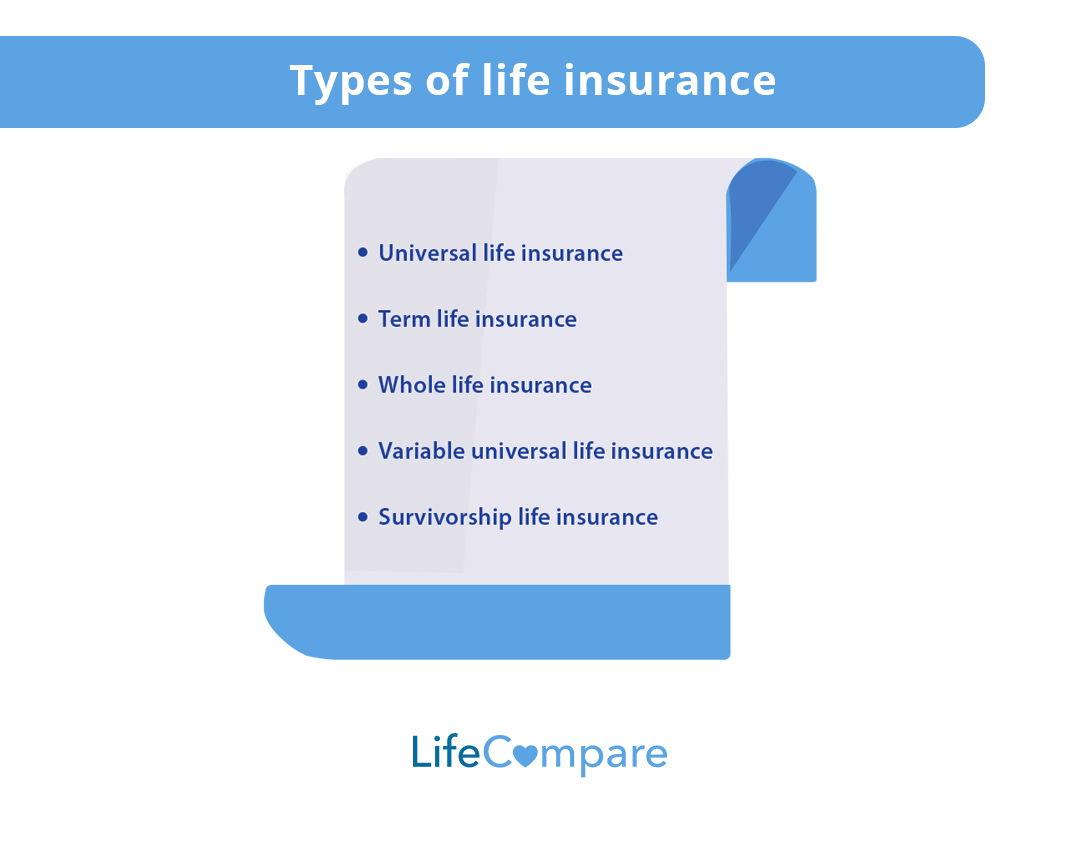

Types of life insurance

Types of life insurance protection products include cover for single people as well as couples, and policies have varying term lengths to suit the holder’s needs.

When looking for life insurance, you should consider your lifestyle and needs. You will need life insurance to look after those left behind when you die. Investing in the right type is vital.

The types of Irish life insurance are:

Each type of life insurance has its uses, and you should have a good idea of each one before taking out a policy. If you want to add serious illness cover or specified illness cover you should inquire about it at the same time.

Single Cover

Single cover life insurance is a policy for one person only. It offers cover for the named person on the policy and pays out a lump sum to their estate on the life insured if they die.

A single cover insurance policy is used for business loans, by single parents and by those who are the sole earner in the home.

Joint cover

Joint cover life insurance is for the two names on the policy. It will pay out the agreed lump sum on the death of one of the people, usually on that of the first name on the policy.

When the joint cover life insurance pays out on the death of one person, it ceases to offer cover to the second name.

Joint cover insurance can be mortgage protection for the two names or offer income protection to the family left behind.

Dual cover

Dual cover life insurance is taken out by couples, and both of their names are covered by the policy. If one of the people on the policy dies, it will pay out an agreed lump sum, but the policy will still cover the life of the other name.

The dual cover life insurance covers both names for the same amount. If it pays out €250,000 as mortgage protection, it will pay out the same amount when the second person dies.

Dual cover life insurance is for mortgage protection as well as covering the income of two high-earners in the family.

Term life cover

Term life cover life insurance offers protection for a fixed amount of years. The term life insurance can be for five years, ten years or whatever suits your needs.

A term insurance policy can offer income protection until your youngest child reaches 25. The policy will cease on your death and pay out the lump sum. If you do not die before the term is reached, the policy will end, and the cover will finish.

Term life is also used for debt and mortgage protection. The term is set to the length of the loan agreement, and cover ceases on that date.

Convertible term life cover

Convertible term life cover life insurance has a fixed term, but you can extend it within the time limit set out in the policy. The conversion option must be in the policy from day one and offers many benefits.

With a convertible term life cover, you convert the existing policy into one of a longer term length. You cannot change the amount insured on the policy.

A huge benefit is that you do not need to undergo another medical, when using your option on the convertible term life insurance.

Whole of life cover

Whole of life cover life insurance will pay out the agreed lump when you die, without any term limit conditions. Also known as life assurance, it is life insurance for life and only ceases when you pass away, hopefully when the time is right.

The whole of life insurance leaves a lump sum to your children on your death at any age.

It is often used to cover inheritance tax and other costs that add a financial burden to the family when you die.

Who offers life insurance?

All the major insurance providers offer life insurance in Ireland. There is a wide market available, and those looking for life insurance have a good choice of policies. Life insurance companies are regulated by the Central bank of Ireland to ensure the quality of their plans.

When looking for life insurance cover, you need to know that your provider suits your needs. Life insurance that does not cover you fully can leave your family with financial problems if you pass away before your time.

Life insurance is essential when you need it, so always go with the company that knows what they are doing.

The providers of Irish life insurance are:

Life Compare deals only with insurance companies regulated by the Central Bank of Ireland to provide the right cover for you at the best monthly premiums.

How much is life insurance in Ireland?

The cost of Life insurance in Ireland starts from as little as €70 per month up to any amount to match your circumstances. You need to figure out what you want the life insurance for and how much money you can afford on monthly premiums.

The cost of Irish life insurance depends on a few variables. We are all different, and life insurance has to suit your needs.

How much is life insurance in Ireland depends on:

There are many factors that will effect the cost of your life insurance policy. These include:

The amount of cover

The amount of cover is the money the policy pays out on the death of the applicant or applicants.

If it is to cover a mortgage or bank loan, it will match that figure. Other lump sums are calculated to make your family financially secure or maybe to cover funeral expenses.

You should always get the correct amount of cover, not the cheapest policy.

The age of the applicant

The age of the applicant makes a big difference to how much is the policy premium. Life insurance costs can go up the older the applicant is, as, unfortunately, their death becomes more likely.

A younger person will have longer to pay their premium, and the cost of the life insurance usually reflects the difference.

The term length

The term length is another variable that affects how much is life insurance in Ireland. If you want fixed term life insurance, you will pay a certain amount for the set number of years.

When you opt for whole length or convertible length life insurance, the premium costs may be higher, but you are covered for life.

Term length is an important factor in determining how much Irish life insurance costs.

The health of the applicant

The health of the applicant will have a considerable bearing on the cost of life insurance. A smoker with an existing illness will pay a lot more than a non-smoker with a clear health record.

You may need to undergo a medical before taking out life insurance, and the results will have a bearing on the cost of the monthly premium.

All four factors will influence the cost of a life insurance. Our Life Compare calculator will give you a quick idea of costs when looking for the best life insurance policy.

Make an inquiry to find the best life insurance policy for you

Make an inquiry to find the best life insurance policy for you at Life Compare. We work with all the major life insurance companies to bring you the best deals on the right policies.

Our easy-to-use life insurance calculator will ask you a few standard questions to help you figure out the costs of a life insurance quote.

Life Compare has the experienced staff to help find you the life insurance to suit your needs. Getting you the right policy with the right company is what we do.

Contact Life Compare today for all your life insurance needs.