Dual cover life insurance provides cover for parents, couples and partnerships. It is a popular form of life insurance in Ireland that insures both people for the term of the policy.

In Ireland, dual cover life insurance is a great way to provide for dependents left behind if you die. If one person dies, the policy pays out while it continues to insure the life of the one left behind.

You never know what may happen and having dual cover life insurance removes any financial risk for the family.

There are many benefits to dual life insurance cover, and it could be perfect for you.

Table of content

What is Dual Cover life insurance?

Dual cover life insurance covers both lives until the term limit of the policy. If one person dies, the dual cover life insurance policy will pay out but continue to cover the second person.

The dual cover life insurance will also pay out when the second named person dies. You are insuring both lives for the agreed term, and the policy pays out when both people die.

You need life insurance to leave behind a lump sum for your loved ones. Life insurance is also used to pay off debts and clear the mortgage.

Having dual cover life insurance offers extra financial security not available with other policies. The dual cover pays out on both lives, regardless of who dies first.

It is a benefit not everyone realises until the dual cover life insurance pays out to the family.

When does Dual Cover life insurance pay out?

Dual cover life insurance pays out when one or both of the named people on the policy dies. It doesn’t matter who dies first; the policy will still pay out on each person’s death.

For those left behind, it will be a great comfort to receive the lump sum to cover costs and outstanding payments when a parent dies. Not having a breadwinner to pay the mortgage, cover medical bills or look after college fees can put an incredible financial burden on the family.

Alternatively, if the second person later dies, the family may lose their prime carer. It costs money to provide full-time childcare in Ireland; over €9000 per child is the annual average.

The dual cover life insurance pays out on the death of both named people on the policy. The worries of paying the mortgage and providing childcare are lifted by the payouts from a dual care life insurance policy.

You can also take out Joint Life cover, but there is a difference with dual life insurance cover.

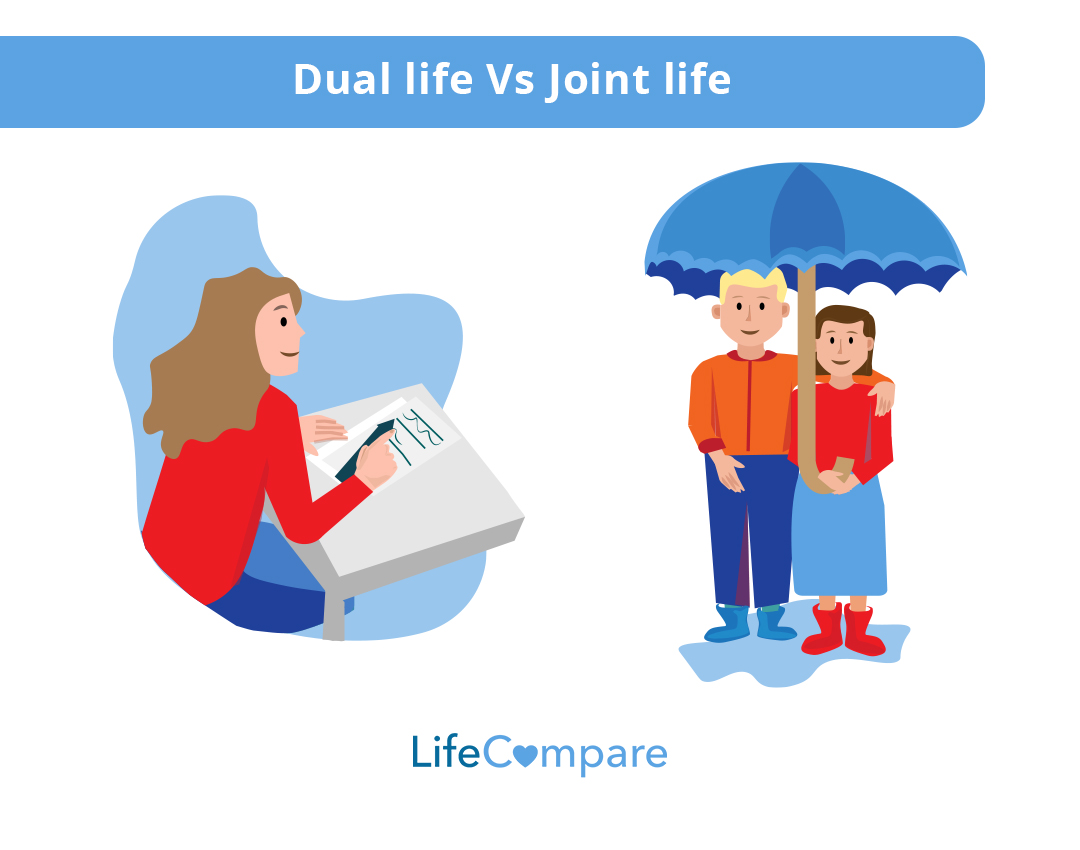

Dual Life insurance Vs Joint Life insurance?

The difference between dual cover life insurance and joint life insurance is that dual cover pays out on the death of both people on the policy.

A joint life insurance policy has many benefits, but it will only pay out on the death of one of the named people on the policy.

It is usually on the death of the first person though some policies only pay out after the death of the second participant.

In a dual cover life insurance policy, two people take out a policy for an agreed term. The policy will pay out on the death of the first person and on the death of the second one too. Both deaths have to take place within the term limit of the policy.

The dual cover life insurance policy may cost a little extra, but you get a huge bonus in that it covers both people on the policy.

Can Dual Cover Life insurance be whole life or term life?

Yes, dual cover life insurance can be whole life. The policy pays out on the death of the first person and on the death of the second, providing they keep up the premiums.

A dual cover life insurance policy can be term life too. The term life option is popular with parents looking to provide cover for their children until they are financially independent.

The dual cover life insurance policy works the same way, regardless of whether it is whole life or term life.

It will still pay out on the deaths of both named policyholders once the policy premiums are paid.

What does dual life cover when my partner or I die?

Dual life covers the agreed amount on the policy when you or your loved one dies. It does not matter who dies first or whose name comes first on the policy – the dual Life insurance cover still works the same.

If you take out a dual life insurance cover for your mortgage and one of you dies, then the policy will clear the mortgage for the remaining person.

When they die, the policy will pay out the value of the dual cover life insurance plan to the dependents or estate of the deceased.

The same is true of a dual life cover taken out to look after the children in case you die. They will get the agreed lump sum, and the policy will stay valid for the partner on the policy.

For example, if the dual life insurance cover is for €250,000 and one parent dies, it pays out the full amount. When the second parent dies within the term, the policy pays out another €250,000.

Dual life insurance covers you for what is agreed on in the policy and covers both names on it.

How much is Dual Cover Life insurance?

Dual cover life insurance starts at less than €70 per month. Like all insurance products, there is not one fixed price for any policy, only guidelines.

You have many options to consider when taking out dual cover life insurance. Do not go for the easy option of the first quote without taking a look at the variables.

You have to consider how much income is lost on the death of you or your partner and who will benefit. Variables in dual life cover include the age of the applicants, the term length of the policy and even the amount insured.

Add-ons like serious illness cover or funeral costs may add to the premium but are worth it if needed. Try the Life Compare life insurance calculator to help you get an idea of costs and policy options.

Often the question is not how much is dual cover but which insurance company offers the best dual cover life insurance policy.

Who offers dual life cover?

All leading Irish life insurance companies offer dual life cover. Each company has excellent policies, and at Life Compare, our job is to find the right one for you and your partner.

Dual life cover is an excellent way to ensure your loved ones are looked after when you or your partner passes away. Your mortgage could be cleared and college fees covered.

If you choose the wrong policy or company, you may not get that cover.

When looking at dual life insurance cover, it saves time and money to have expert advice on board.

Contact Life Compare

Contact Life Compare for expert advice on dual cover life insurance. We have the experience and the expertise to guide you through finding the right dual life cover policy.

Life Compare constantly studies the market and deals with the best life insurance companies in Ireland. Only by knowing what is on offer in the dual cover life insurance market can we offer you the best deals and premiums.

Dual life cover need not cost you an arm and a leg, even with all the right add-ons and cover options.

Contact Life Compare today for all your dual cover life insurance needs.