Having financial protection is something that can help in the most crucial times. Whether you are insuring just yourself or for the benefit of a whole family, you may not know how important insurance is until you need it.

Popular forms of coverage in Ireland include life insurance and income protection insurance. You may be asking yourself, what is the difference?

These two types of insurances have some similarities but are ultimately different policies. This means one may suit one person more than another.

At Life Compare, we are eager to make sure you get the type of coverage that helps you the most. Get in touch today and we can help you in any way we can.

Table of Content

What is life insurance?

Life insurance in Ireland is a policy that will pay out a lump sum following the death of the holder. This will be a tax-free lump sum that can offer financial protection to those left behind.

For example, life insurance is popular among parents who wish to add financial security to their children should an unfortunate situation occur.

You can choose the term of your policy, meaning you decide how long you are covered.

What is income protection insurance?

Income protection insurance is a financial safety net that will pay a regular income in the event that you become injured or ill, leaving you unable to work.

This means that even if you are out of work for a significant amount of time due to medical reasons, you will not have to face financial stress.

You can choose how much of your income you cover, up to 75%.

How much is life insurance vs income protection insurance premiums?

Life insurance and income protection insurance do not have fixed premiums. There are several factors that will impact the amount you pay for your premium.

A lot of the variable factors in the cost will be your own choice, such as length and amount of coverage. There are also going to be factors you can’t control, such as age and gender.

By getting in contact with Life Compare, you will get a better idea on how much you may expect to pay for your coverage.

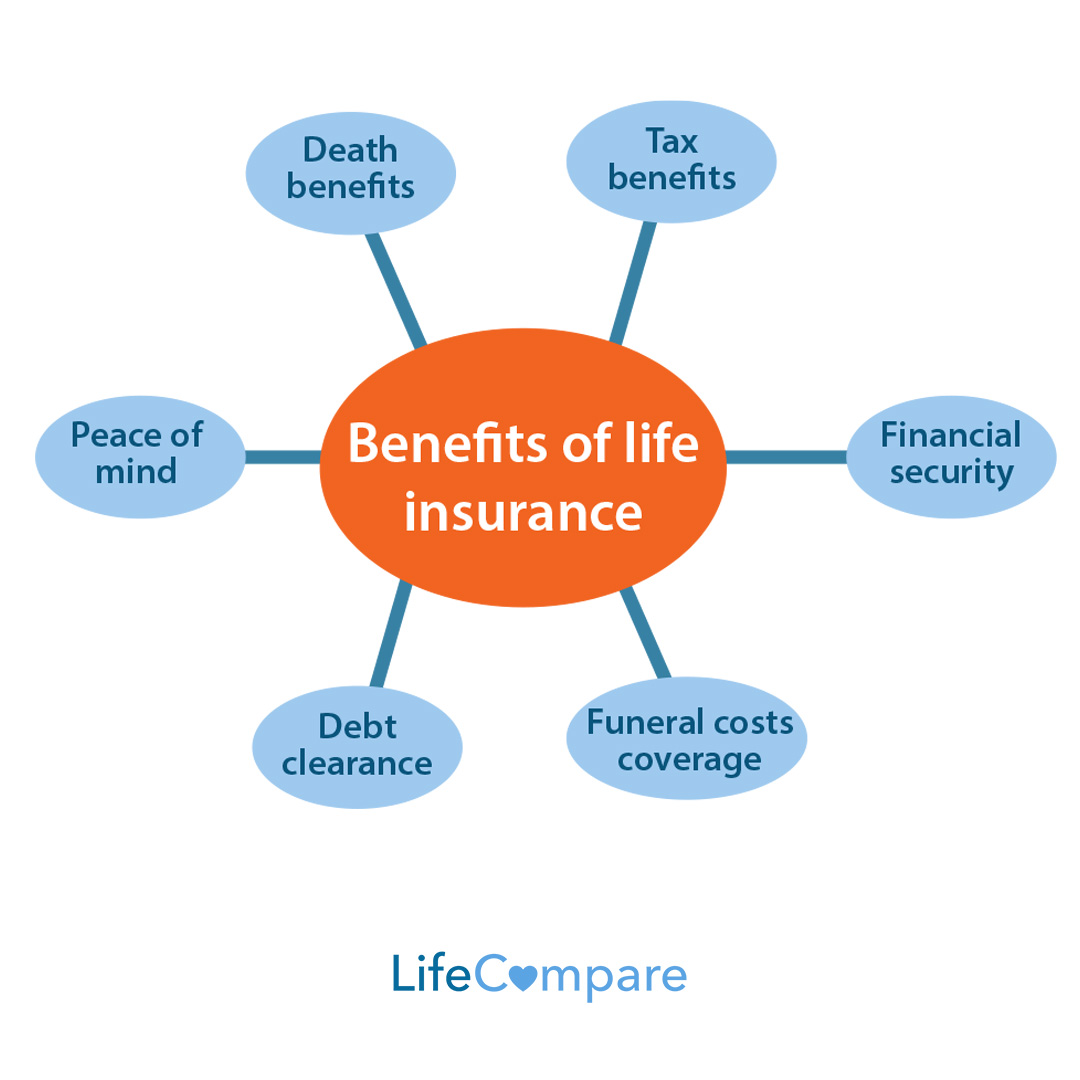

Benefits of life insurance

There are a significant amount of benefits for people who choose life insurance. Some of the benefits include:

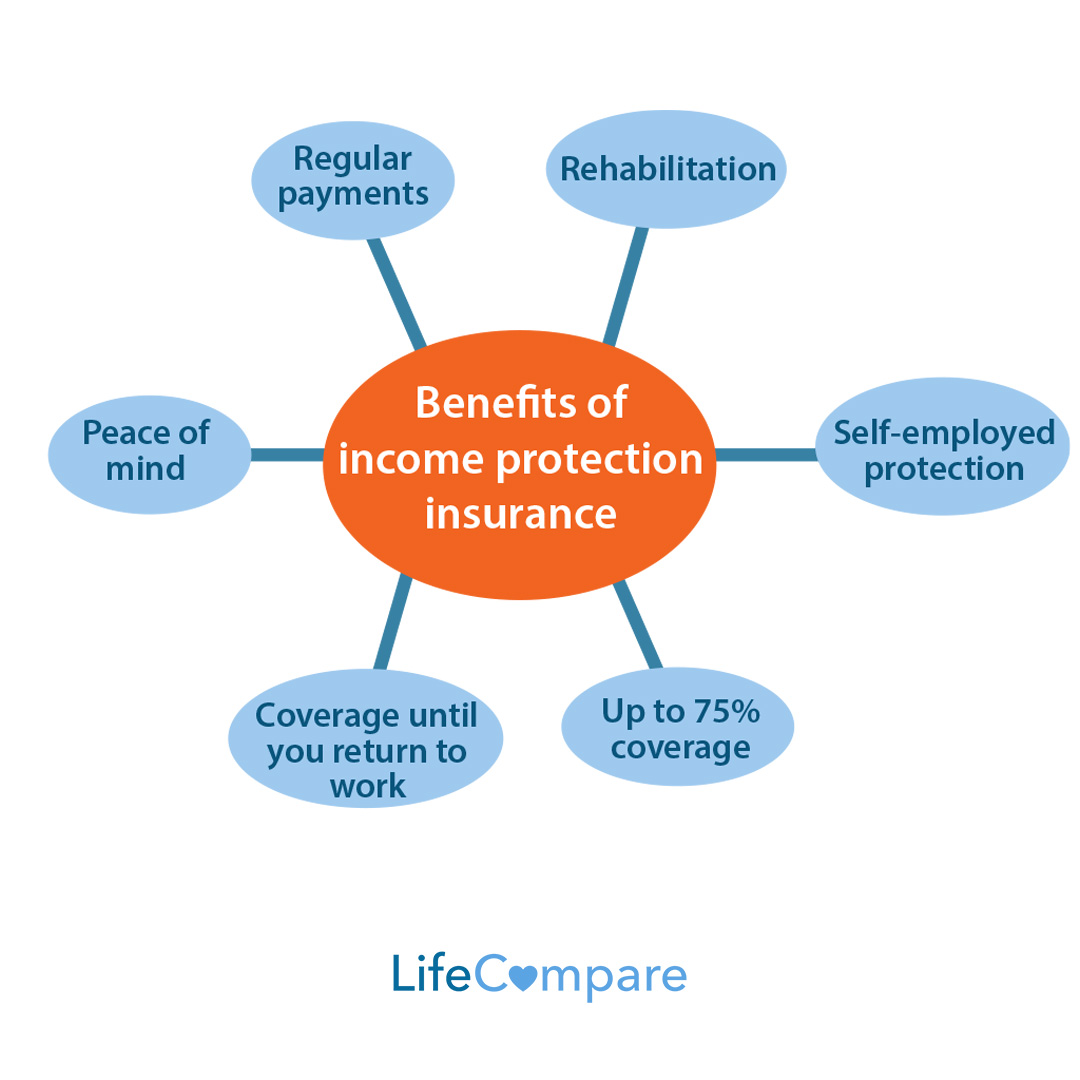

Benefits of income protection insurance

Income protection insurance also has a great series of benefits. Some of the benefits include:

Factors that influence life insurance premiums

There are several factors that have the potential to increase or decrease your life insurance premiums. These factors include:

Factors that influence income protection insurance premiums

Your income protection insurance premium will be influenced by many key factors. They include:

Who is suited to each type of cover?

If you are a single person with no dependents, then it is likely that income protection insurance is the more fitting option. This means that if you are out of work, you won’t be put into a bad place financially.

For people with families and dependents, they should consider life insurance. This means that in an unfortunate situation, your loved ones will be taken care of.

You can choose single or dual life insurance, depending on what coverage would suit the situation best.

Those with families and dependents should also consider income protection insurance. A lack of income could lead to a stressful situation for you and your loved ones, protection would help to prevent this.

For more personal advice, reach out to our team of experts today. They can get a better understanding of your situation and advise you from there.

Life insurance providers Ireland

At Life Compare, we look at all of the life insurance providers to see what policy suits you best. The providers we compare include:

Income protection insurance providers Ireland

There are many insurance companies that offer income protection to Irish people. At Life Compare, we compare the following income protection insurance companies:

Get professional advice today

At Life Compare, we pride ourselves on our expert services. Making the decision between life insurance and income protection insurance can be difficult, which is why we want to help.

Reach out to us today and we can provide some guidance based on your situation. Together, we can provide a solution that can give you the best outcome and peace of mind.