Term life insurance covers the policyholder for a fixed length of time. The length of time could be any number of years, from two to 50, and the cover is usually taken out to provide a lump sum to loved ones when you pass away.

The number of years is specified in the term life insurance policy. You can choose to cover a business loan, your mortgage or even until your children become financially independent.

If you die during the term, the policy pays out the agreed fixed sum to a named individual. Like any life insurance policy, it only pays out on the policyholder’s death and to the named person.

The policy will cease once the term is completed or if you die during the specified life term.

Term life insurance is an excellent form of life insurance which pinpoints cover where needed.

Table of content

What is term life insurance?

Term life insurance is an insurance policy with a fixed number of years cover. Unlike life insurance which can give cover up until the day you die, a term life insurance policy ceases cover after the agreed number of years.

You take out term life insurance for a specific purpose, such as covering the family home in case you die before the mortgage is paid. Term life insurance has many uses and is a popular form of life insurance.

Knowing how term life insurance works and its benefits will help you choose the best policy to suit your needs.

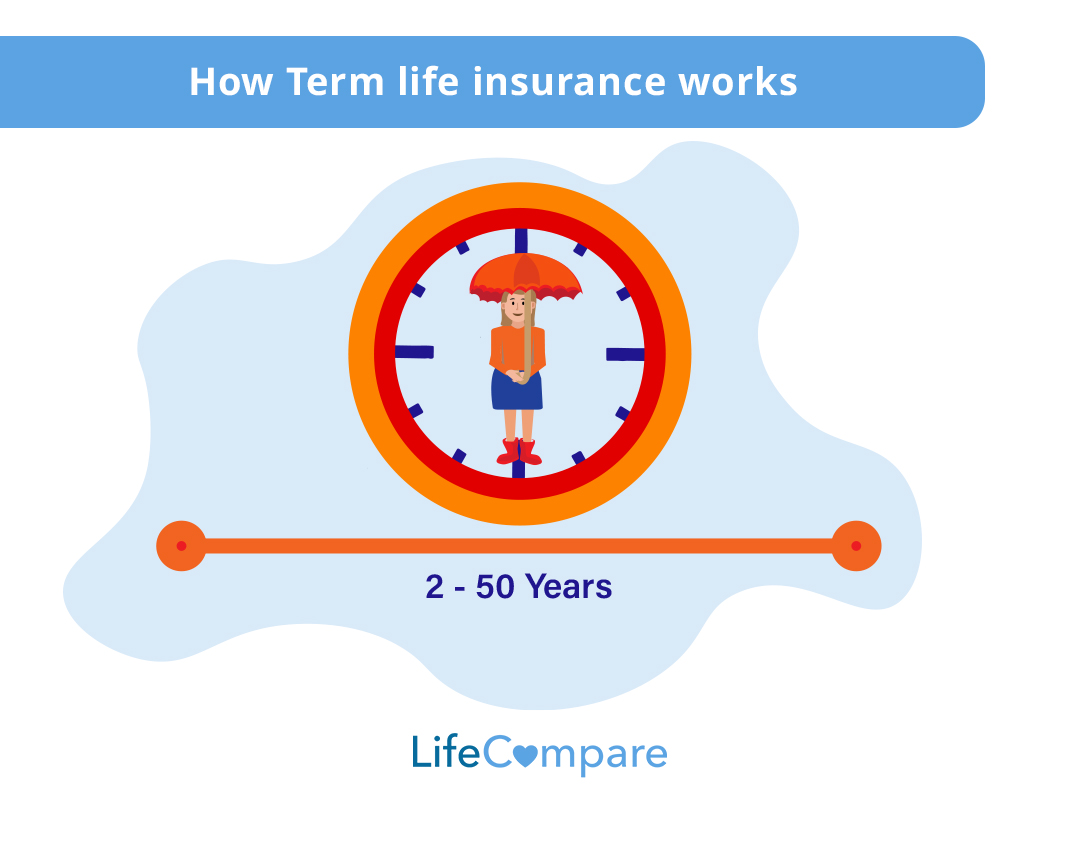

How does term life insurance work?

Term life insurance works by taking out a life insurance policy for a fixed length of time. The life insurance policy term can be anything from two to 50 years, and it pays the agreed sum to a named recipient if you die within the term.

Your life insurance company will offer a term life insurance policy to suit your needs. The policy will have a fixed monthly premium, and the policy is only active for as long as you keep up the payments.

If you die within the time of the term life insurance policy, the insurance company will pay out the agreed amount of the policy. It could be used to cover the balance of your mortgage, home improvement loan or the costs of your children’s time in education.

There are different types of term life insurance, and there is one to suit your needs.

What are the types of term life insurance?

There are three types of term life insurance, and you should find a policy to suit your needs. Each type of term life insurance has its uses, and your insurance company will guide you to the best one.

Types of term life insurance:

Single cover term life insurance

Single cover term life insurance is for one person only. The policy is taken out in their name and pays the fixed lump sum on their death.

Single cover term life insurance is a good option if you are the sole earner or the primary income earner in a household.

The lump sum will ensure the family and loved ones are cared for if you die during the single cover life insurance policy term.

Joint cover term life insurance

Joint cover term life insurance is for two named people on the insurance policy. The policy will pay out on the death of one person on the policy, and the policy will then cease.

In most cases, the policy will pay out on the death of the first named person, though it can be set to the second individual or a specific one of the couple.

The joint cover term life insurance policy is suitable when both couples earn an income outside of the home.

The insurance policy lump sum will take the financial pressure off the individual left behind and help secure their future.

Dual cover term life insurance

Dual cover life insurance is also for couples, and both are named on the policy. The difference between dual cover and joint cover term life insurance is that there is a lump sum paid after the death of both individuals.

The insurance company pays a lump sum when the first name person dies but also pays a lump sum if the second person dies too.

The policy does not cease after the first pay-out and covers the second individual until the term finishes, or they pass away within the determined time of the policy.

Features of term life insurance

Features of term life insurance include providing for loved ones left behind and fixed monthly payments for the term of the policy.

Features of term life insurance are:

Term life insurance features allow you to see what policy might suit your needs. A term life insurance policy has many benefits and gives peace of mind when considering your family if you pass away.

Many life insurance companies offer term life insurance in Ireland, and we can help you choose the best option for you.

Our Process

We make the life insurance process as simple and streamlined as possible, and that’s one of the reasons we’re maintain a 5★ rating from our customers!

Assessment

The first step is to take a few moments and fill out our interactive life insurance assessment form.

Review

Your assessment is sent directly to a life insurance expert. They will review your data, get your quotes and schedule a call with you to discuss your options.

Quotes

Your life insurance advisor will talk you through the pros and cons of each policy. Once you have decided which policy you would, your advisor will submit your application on your behalf.

Who offers term life insurance in Ireland?

Many companies offer term life insurance in Ireland. It is a simple form of insurance with plenty of benefits, and you can use it to cover loans, mortgages and your children’s education if you pass away.

You do not want to leave your family in financial difficulties if you pass away at an early age. Term life insurance from one of the many life insurance companies will cover your needs.

Companies offering term life insurance in Ireland:

Each company has its benefits, and you should look at what each company offers with their term life insurance policies before making up your mind.

Term life insurance is for everyone looking for a policy to leave a lump sum to loved ones.

People who are best suited for term life insurance should consider all options from each company to get the right cover.

Who is best suited to term life insurance?

Anyone looking to leave a lump sum to loved ones is best suited to term life insurance. A term life insurance policy gives peace of mind to the holder, and it has many uses.

People best suited to term life insurance are those:

People looking for a term life insurance policy should consider which type suits them and look at the frequent questions asked about the policy.

FAQs on Term Life Insurance

FAQs on Term Life Insurance answer the popular questions on this type of insurance policy and can help those looking to take out a life insurance policy.

Learn more about term life cover today

Learn more about term life cover today by contacting us at Life Compare. We have the experience and the expertise to help you choose the right term life insurance policy.

We work with the best life insurance companies in Ireland to get the best policy deals for our customers. We know the market, and we know life insurance and work to get you excellent term life cover.

Term life insurance cover is a perfect policy to take care of the financial needs of your loved ones if you pass away unexpectedly. The mortgage will be paid, any outstanding loans covered, and you need not worry about the children’s education.

Contact us at Life Compare today for all your term life insurance needs.